The current situation in the world, rising prices and declining economies due to the Ukraine war has raised several concerns among economists whether we are in a recession. But how do we decide whether a country is facing recession? What’s the current situation of the economy? Let’s find out!

Contrary to common opinion, a recession is not defined as two consecutive quarters of declining real GDP. It’s also called “Real” inflation as per the economists which is adjusted inflation The formal definition was offered by the National Bureau of Economic Research’s Business Cycle Dating Committee. A recession, according to them, is “a dramatic drop in economic activity that is widespread and lasts for more than a few months.”

So, by definition we’re not in recession, however, certain economists debate that the future is critical when it comes to inflation and price adjustments. The Central Bank has raised concerns that if they’re not cunning within these months then the next 12 months may prove fatal for the economy.

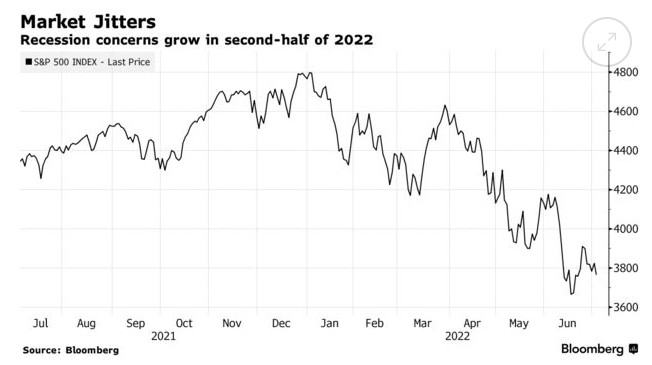

When discussing the stock market, it surely doesn’t look healthy. Majority investors are now looking to avoid riskier investments amid the uneven circumstances and the situations most of the companies are currently going through.

Major stock indexes have plummeted 20% from the recent highs, which shows an overall low of 60% among the stocks. This is due to the consecutive quarters of GDP growth in America. Stocks began to fall steadily earlier this year, then plunged, instilling fear and panic and leading to apocalyptic forecasts of what lies next.

That entails first boosting interest rates. For months, there has been a roar among economists regarding the perils of a recession. As investors left riskier assets, the S&P 500 plummeted as much as 2.2 percent on the first trading day of a shortened week. Treasury yields have declined, with the 10-year yield currently resting at 2.8 percent. Meanwhile, the dollar increased, making dollar-priced items less tempting. The price of oil has fallen below $100 per barrel.

Most of the recession is now looking at Federal Reserves of the USA, where the Fed has decided to raise its policy points by 75 basis points. This would accompany a succession of 25 [basis points] until the Fed funds rate reaches 3.75 percent by February of the following year.

To Sum it Up

The overall economies of the countries and the stock market display as if we’re in recession. Currently, the economy is at a critical level and the forecasts show that the decisions taken by America and the Fed decides the future for the economy as well as the stock market portfolio.